….As they reject Ofori-Atta’s unpopular electricity VAT, emission levy

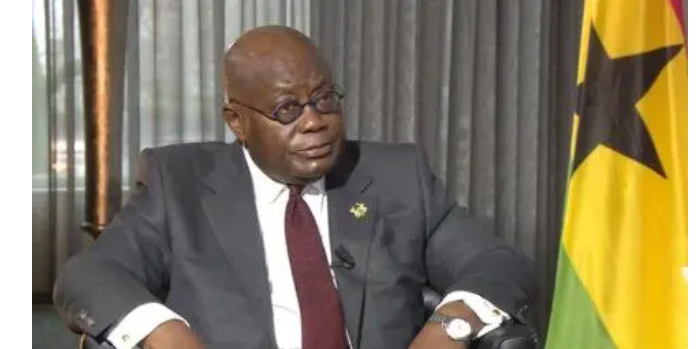

Tensions are rising within the governing New Patriotic Party (NPP) as the National Organiser, has openly disagreed with the Akufo-Addo government by calling for an immediate withdrawal of the recently imposed emission levy and Value Added Tax (VAT) on electricity bills by the Finance Ministry and Ghana Revenue Authority (GRA).

The demand signals a growing rift between the party and the government, with Henry Nana Boakye, alias “Nana B,” calling for an immediate withdrawal of the controversial emission tax.

“Nana B”, a lawyer by profession, argues that the emission levy is unnecessary and should be retracted by the Finance Minister, Ken Ofori-Atta immediately.

He said, he had supported other levies in the past, but could not support emission levy in the absence of key government requirements on checking population, climate change and global warming.

“Nana B’s stance aligns with many who see the emission levy as another clandestine means of emptying the pockets of Ghanaians.

The Akufo-Addo government, has been facing public backlash over a series of tax measures, including the Electronic Transaction Levy (E-Levy) and the Income Tax (Amendment) Act 2023 (Act 1094).

The E-Levy is a tax applied on transactions made on electronic or digital platforms, including those made for school fees. After over a year, it amended the percentage from 2percent to 1.5percent.

The same government, had also attracted lots of disdain over the Income Tax (Amendment) Act 2023 (Act 1094) a withholding tax of 10percent on all winnings, including betting, lottery, and other games of chance are subject to the withholding tax at the point of payout.

Critics argue that these taxes are excessive and burdensome on both businesses and the general population.

Economists, including Professor Godfred Bokpin from the University of Ghana Business School, have voiced concerns over the government’s tax structure.

Prof. Bokpin, during an interview on the Sunrise show on 3FM, stated that the current tax regime resembles “state-sponsored robbery” and impedes private sector growth, urging the government to consider tax relief measures.

The NPP National Organiser on Accra-based Peace FM last Friday, February 2, 2024, aside from condemning the emission tax, also announced the party’s rejection of the VAT on electricity bills which the government through the Ministry of Finance intends to introduce, insisting they are unpopular policies, particularly in an election year.

His stance aligns with that of the NPP and demands an immediate withdrawal of the levy.

The emission levy came into effect on Thursday, February 1, 2024, with the government claiming it’s to tackle greenhouse gas emissions, promote the use of eco-friendly technology and green energy, and improve environmental management, while controlling levels of air and water pollution.

Under section 4(4) of Act 1112, individuals required to obtain a road use certificate, such as the Driver and Vehicle Licensing Authority (DVLA) and other testing centres, must provide evidence of payment of the emission levy before receiving the certificate. Vehicle owners, have been advised to register and pay the levy only on the Ghana.gov platform.

The scheduled amount for the emission levy is as follows: GHS75 per annum for motorcycles and tricycles, GHS150 per annum for motor vehicles, buses, and coaches up to 3000 cc, GHS300 per annum for motor vehicles, buses, and coaches above 3000 cc, and GHS300 per annum for cargo trucks and articulated trucks.

In addition to rejecting the emission levy, Nana B, announced the party’s opposition to the proposed VAT on electricity bills, labelling them as unpopular policies, especially in an election year.

The government’s measures have also drawn criticism from business bodies, including the Food and Beverages Association, advocating for the relief of private sector tax burdens to facilitate economic progress.

Prof. Bokpin, had urged the Akufo-Addo government to consider tax relief measures, asserting that the current tax structure imposes a heavy burden on businesses, emphasizing that the prevailing tax regime not only constrains businesses, but also impedes the growth of a private sector-led economy.

Responding to questions, Prof. Bokpin said, what Ghana is practising is not taxation, it is robbery. What Ghana is presiding over right now is not taxation, it is not borne out of tax policy, State-sponsored robbery is what we have in the form of taxes. Where will you find the kind of taxes we have? Go to the ports and see the layers of taxes, how do you do that and expert your private sector to grow and create jobs?”

According to Nana B, emission levies are typically imposed on countries that have made considerable progress in using electric vehicles to combat climate change.

He believes that Ghana has not yet reached a stage where electric cars are prevalent enough to justify imposing such a levy on petrol and diesel vehicles.

In November last year, Prof. Bokpin, articulated that the layers of taxes at the ports severely hamper the capacity of the private sector to thrive and generate employment opportunities.

“We will be unique to think that by presiding over this fiscal regime, tax, and the rest of them, some way somehow, private sector-led economic transformation and inclusive productivity growth will just happen, no.”

The sentiment expressed by Prof. Bokpin, aligns with the appeals made by various business bodies, including the Food and Beverages Association. The association has highlighted that sustained economic progress necessitates relieving the private sector of excessive tax burdens, encompassing corporate, consumption, and income taxes.

Drawing attention to the adverse effects of over-taxation, the association emphasized how businesses are excessively taxed, and their capability to invest in research and development for expansion diminishes. This inhibits their ability to achieve economies of scale, impeding optimal operational efficiency.